Context

As BNP Paribas was going through an Agile transformation to accelerate time-to-market for its growth initiatives, it faced execution challenges due to organizational inertia and a risk-averse culture. Business units and supporting functions (legal, risk, compliance, IT) operated in silos, slowing decision-making and limiting customer-driven prioritization. Project teams lacked empowerment and hesitated to take risks.

The success of the Pathways program (a digital platform for women entrepreneurs) became a model for cultural change, demonstrating how a bank could break down silos, adopt an Agile mindset, and empower smaller teams to drive customer-centric innovation. In 2019, I got the opportunity to showcase the Pathways program at the bank’s Global Innovation Summit in Paris, receiving widespread media coverage in the U.S. and Europe.

Challenges

Addressing following challenges was critical to ensuring a customer-centric, data-driven, and agile innovation process.

Ideation challenges

- Building a cross-functional team with representation from key functions such as legal, risk, architecture, IT, and marketing.

- Limited access to data/KPIs needed to establish a baseline for the current state.

- Lack of rapid prototyping and design validation, slowing iterative improvements.

- Missing prioritization of features and functional requirements based on customer feedback.

- Challenges in identifying key dependencies on other initiatives at both the Line of Business (LOB) and enterprise levels.

Execution challenges

- Lack of continuity of key team members from ideation to execution, impacting momentum.

- Insufficient details in the business case and roadmap, leading to misalignment.

- Absence of early high-fidelity prototypes, delaying visualization of the solution based on customer, employee, and business needs.

- Missing Product Owner role from the business side, creating gaps in ownership and decision-making.

- Process delays in assembling the core delivery team, slowing execution.

- Rigid, waterfall-like project review and funding processes, hindering agility.

My Role

As part of the Corporate Strategy Group, I led the Customer Journey and Design Thinking practice at the bank. Recognizing an opportunity to scale the success of the Pathways program, I proposed a Product Acceleration Framework to enable business units to identify innovation opportunities and shift from a bank-centric to a customer-centric model.

I presented this proposal at the Innovation Council meeting, chaired by the CEO, with key executives including the CFO, COO, CIO, and CDO, securing alignment and approval for implementation.

Action

I proposed forming a Tiger Team to partner with business units and accelerate innovation programs aligned with the bank’s U.S. growth strategy. This small, cross-functional team would:

- Leverage Design Thinking, Lean Startup, and Agile Development methodologies to drive innovation.

- Provide seed funding for an MVP upon business case approval.

- Assemble and coach a cross-functional Product Team to ensure sustained progress beyond launch.

The proposal was approved and co-funded by the Corporate Strategy Group and the bank’s Global Innovation Fund. Within three months, I built an eight-member cross-functional team, including an Agile coach, product manager, user researcher, UX designer, technology architect, legal, compliance, and marketing experts.

Solution

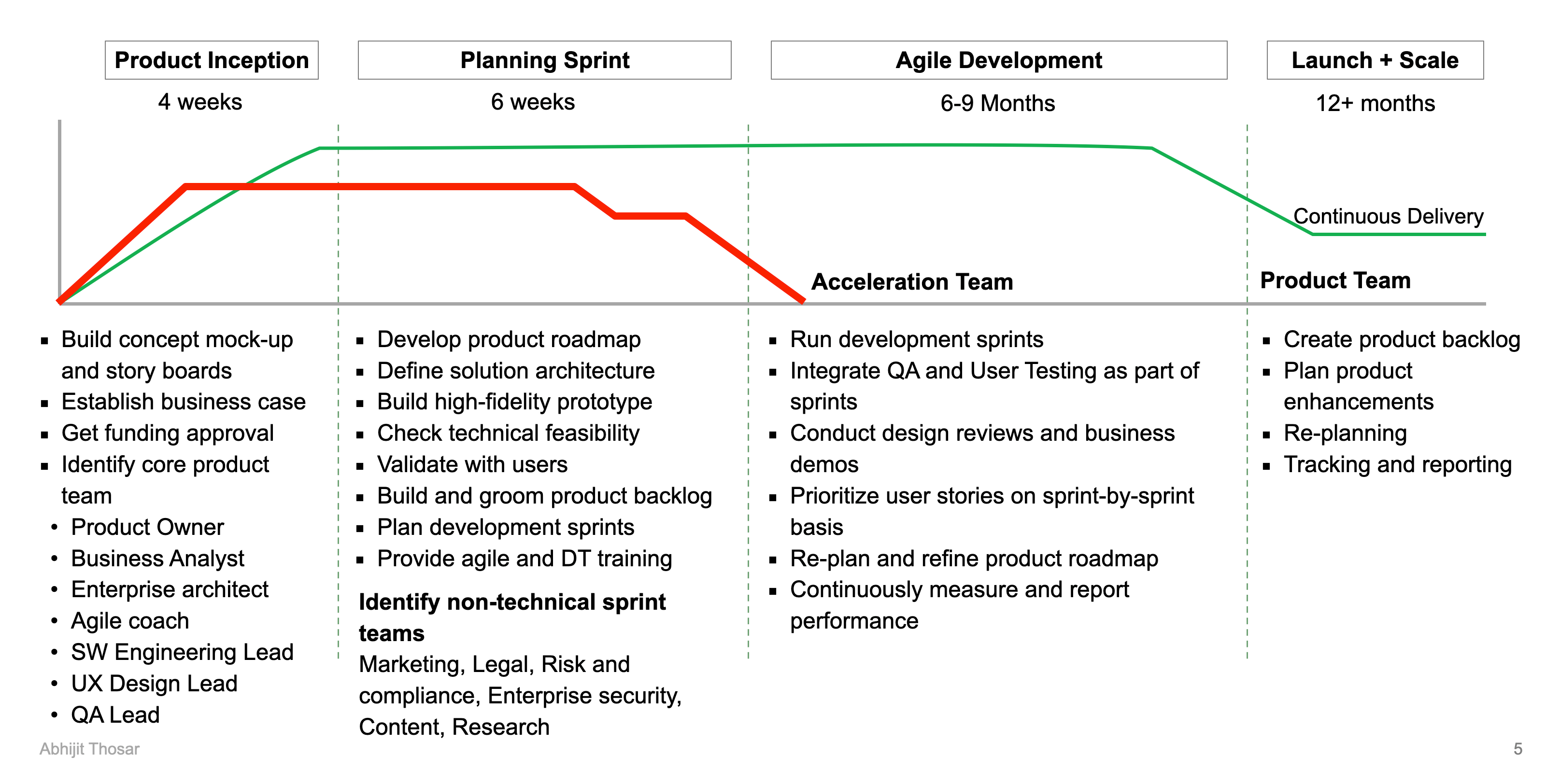

Established a cross-functional “startup” team to prepare the project for Agile execution. The scope included developing a design blueprint, technology architecture, product backlog, MVP definition, and sprint planning.

Role of Acceleration Team (Short term)

- Develop a directional business case, identifying key business metrics and securing initial funding.

- Assemble a product team to jump-start development.

- Build a cross-functional team of experts to ensure early buy-in and accelerate decision-making.

- Refine MVP and product roadmap based on business value and technical feasibility.

- Define product architecture, including technology stack, sourcing strategies, partnerships, and procurement.

- Validate solutions with customers and conduct market benchmarking.

Role of Product Team (Ongoing)

- Create and groom the product backlog, prioritizing key features.

- Plan sprints for Agile development, covering both technical and non-technical workstreams.

- Stand up sprint teams to optimize user story development volume and velocity.

- Establish a tracking and reporting framework for continuous improvement and delivery

Implementation

To drive customer-centric innovation and accelerate product development, a structured approach was designed, integrating Design Thinking, Rapid Prototyping, and Product Acceleration. This framework ensures that business needs, customer insights, and technical feasibility are aligned from inception to execution.

Expanding the impact

Following the Pathways program, I led the Product Acceleration Team to drive innovation initiatives across Wealth Management, Personal Finance, and Home Equity business units. These initiatives focused on enhancing customer experience, improving operational efficiency, and driving business growth:

- Wealth Management – Enhanced investor satisfaction and trust by transforming the financial planning process, performance reports, fee structures, and advisor-client interactions.

- Personal Finance – Optimized underwriting workflows for the partner care team, enabling faster credit exception handling and counter-offer processing, increasing the bank’s share of highly profitable auto loans from premium dealerships.

- Home Equity – Redesigned the Home Equity Customer Journey, making home equity loans easier to apply for and access for the bank’s retail customers.

Driving Cultural Change

In parallel with leading innovation initiatives, I collaborated with Talent Management and Learning & Development Heads to train 3% (~300 employees) of the workforce in Design Thinking and Agile Development. This initiative helped drive cultural change, equipping teams with customer-centric problem-solving skills and preparing the bank for the future of financial services.

See other Case Studies.