Context

Royal Bank of Scotland (RBS) was exploring future opportunities in financial services through Interactive TV platforms in India and emerging Southeast Asian markets. The goal was to expand its retail customer base by leveraging digital banking solutions in growing domestic markets.

To assess feasibility and user adoption, a usability study was conducted, targeting mass-affluent consumers in Tier 1 and Tier 2 Indian metro cities. The study aimed to capture initial feedback on Interactive TV banking, focusing on user behaviors, preferences, attitudes, and concerns across key dimensions:

- Adoption of technology touchpoints

- Privacy and security concerns

- Engagement with Interactive TV services

- Financial services through Direct-to-Home (DTH) channels

These insights provided valuable input for shaping the future strategy of Interactive TV-based financial services in emerging markets.

My Role

As Research and Design Director, I worked closely with RBS business stakeholders to define research objectives, establish the approach, and guide the end-to-end research process. My responsibilities included:

- Framing the research objectives to align with business and market expansion goals.

- Developing a prototype for testing Interactive TV banking concepts.

- Creating a structured moderator guide to ensure comprehensive user feedback.

- Leading the research process, from data collection and analysis to actionable insights.

I led a five-member team comprising user researchers, a prototyper, and a research coordinator. To ensure accurate market representation, we partnered with a professional market research agency to recruit participants from target households in Tier 1 and Tier 2 cities.

This collaborative approach helped uncover key user behaviors, adoption barriers, and market opportunities, shaping RBS’s strategy for Interactive TV-based financial services in emerging markets.

Target User Segment

The usability study focused on a diverse group of participants representing the mass-affluent consumer base in Tier 1 and Tier 2 Indian metro cities. The key user demographics included:

- Age & Gender – 30 to 45 years, with an equal mix of men and women.

- Occupation – A balanced mix of salaried professionals, business owners, and homemakers.

- Income Level – Lower-mid income middle class, representing a key growth segment.

- Banking & Credit Card Usage – Essential, ensuring familiarity with financial services.

- Digital TV Subscription – Essential, as a prerequisite for engaging with Interactive TV services.

- Subscription Providers – Participants used major Direct-to-Home (DTH) services, including Tata Sky, Dish TV, Big TV, and Bharti Airtel.

This targeted approach ensured that the research captured insights from relevant users, helping RBS tailor Interactive TV banking solutions to the needs of emerging market consumers.

Sample Size: 36 (18 in Mumbai and 18 in New Delhi)

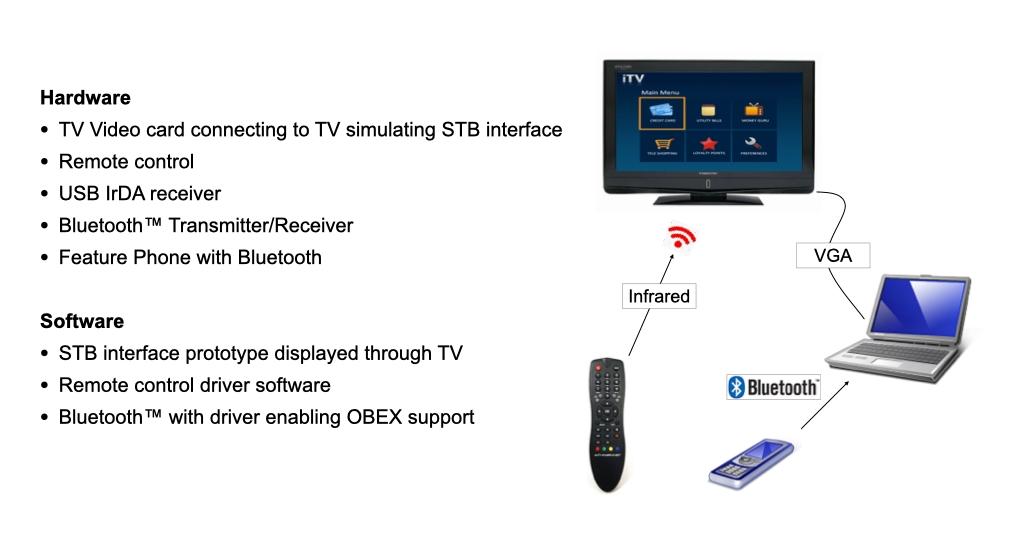

Prototype Setup

Usability Research Setup

| Focus Groups (30 Minutes) – 3 sessions in Mumbai and 3 sessions in Delhi | Conducted this session with all the 36 participants (6X6 in a group) with focus on gauging their level of awareness and to understand their mental model, where they see the value and what they think are the possible hurdles. |

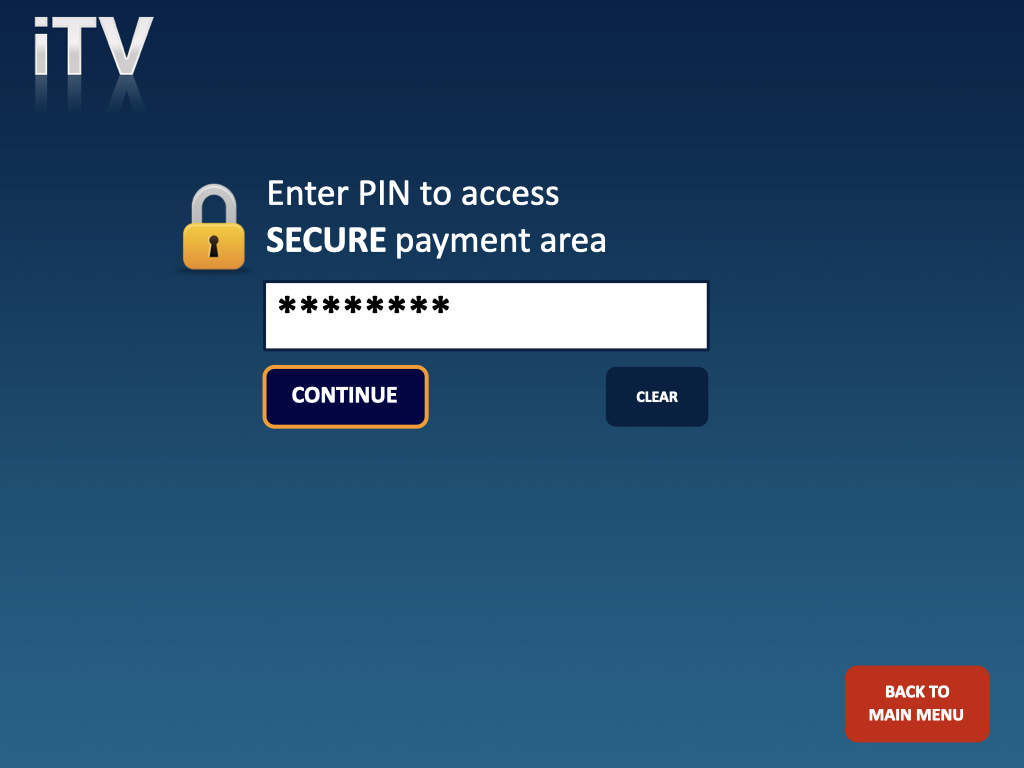

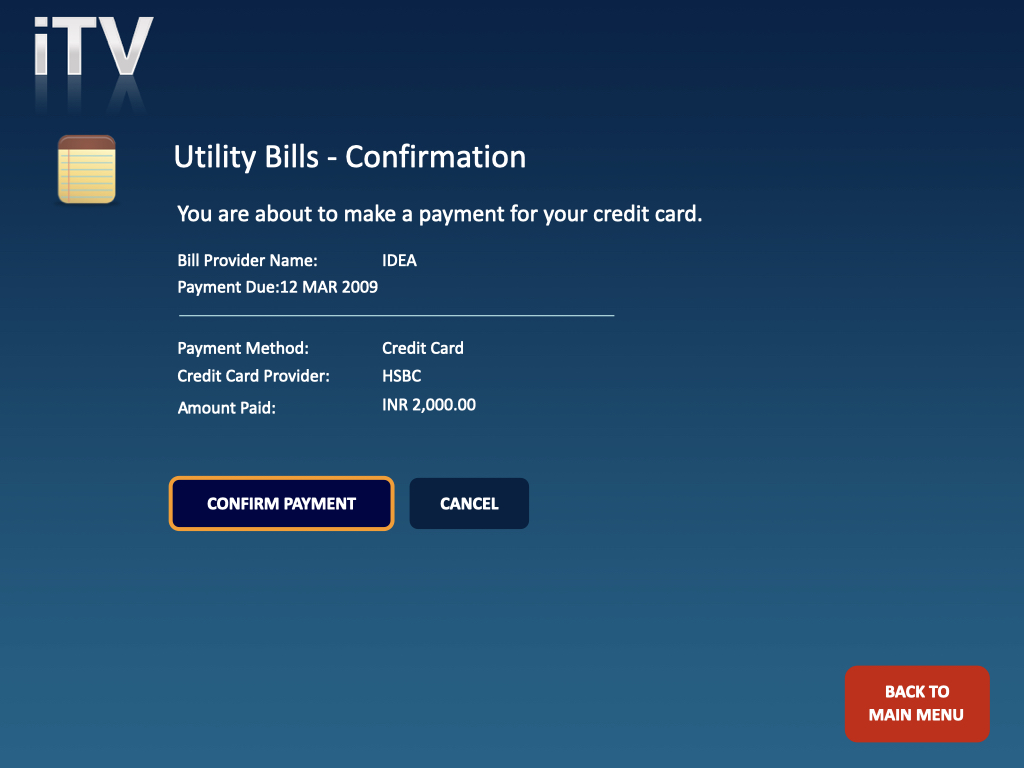

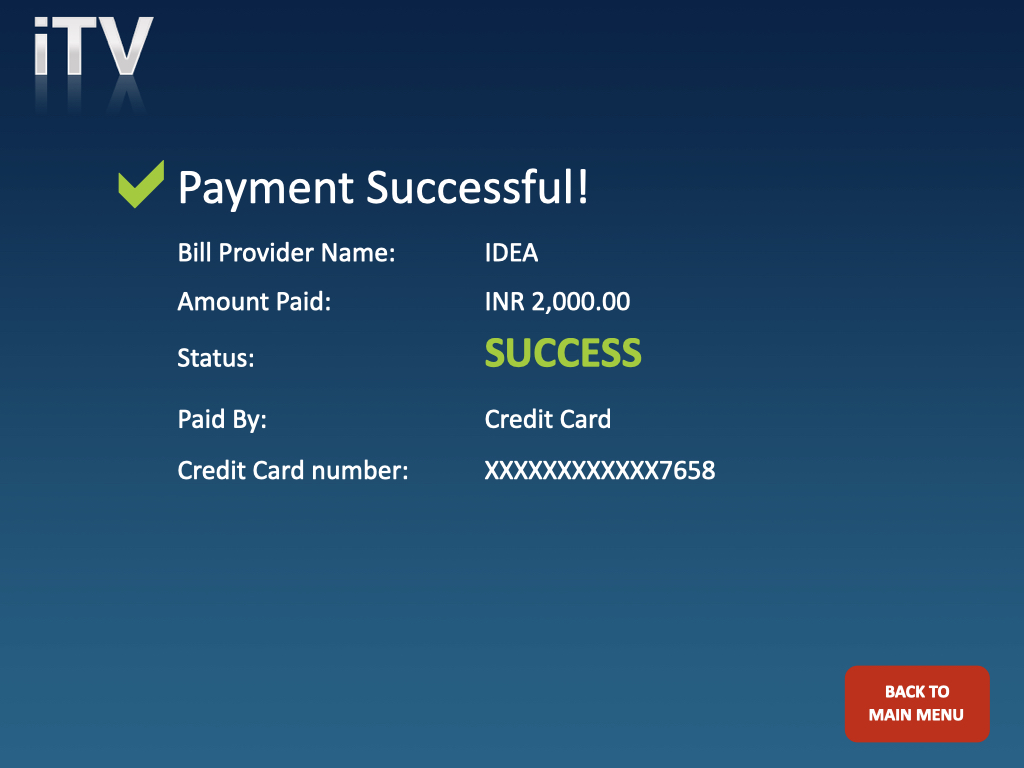

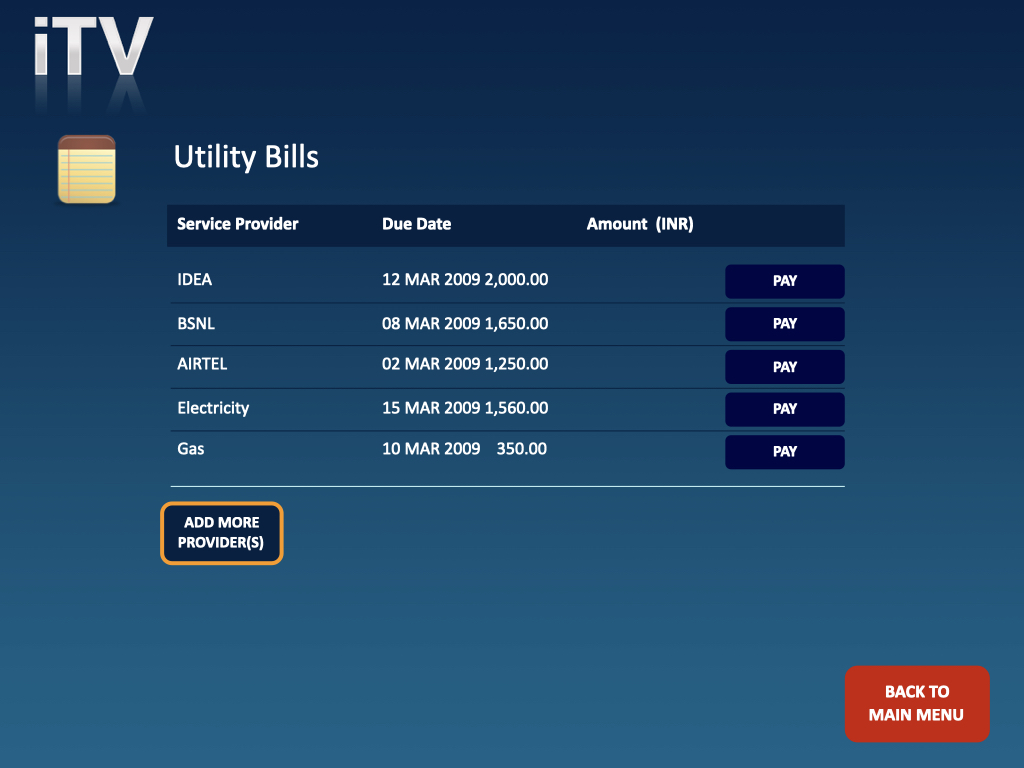

| One-on-one sessions (60 Minutes) – 18 sessions in Mumbai and 18 sessions in Delhi | All 36 participants were asked to use an interactive prototype on the TV and explore. A total of 10 scenarios were tested by allowing them to use only TV remote and remote mobile in tandem. |

| Debriefing sessions (30 Minutes) – 3 sessions in Mumbai and 3 sessions in Delhi | This session followed one-on-one sessions (6X6 in a group) to gather collective feedback about their experiences while interacting with the prototype and to record their views about the concept, overall experience, concerns, value assessments and motivations. |

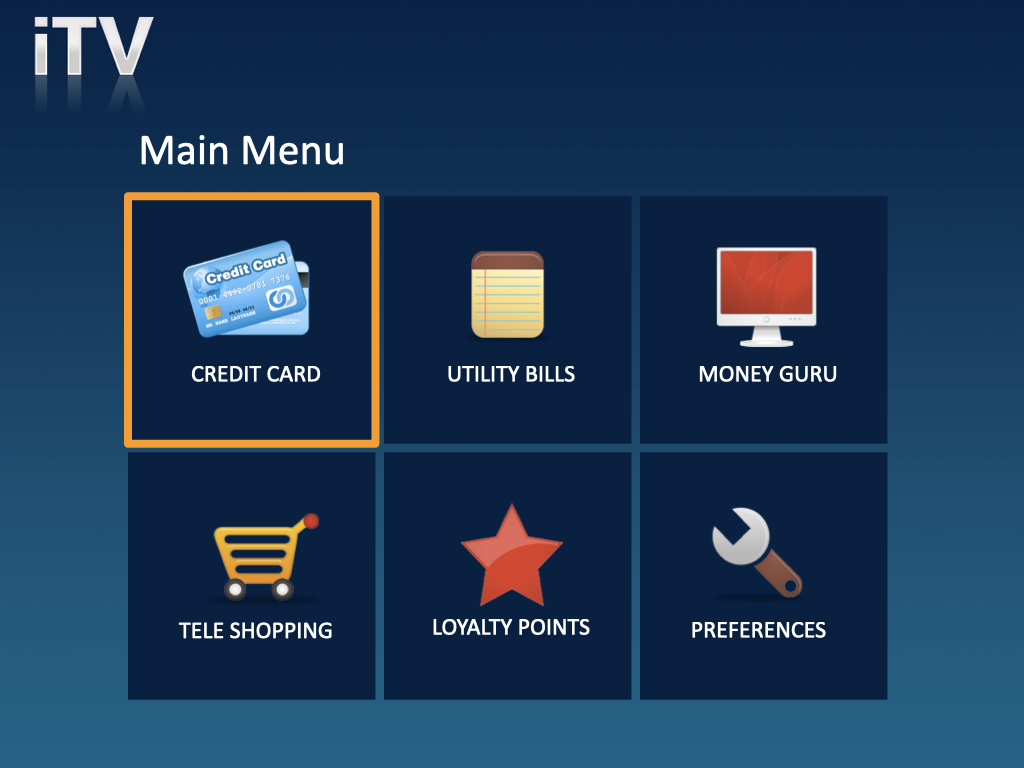

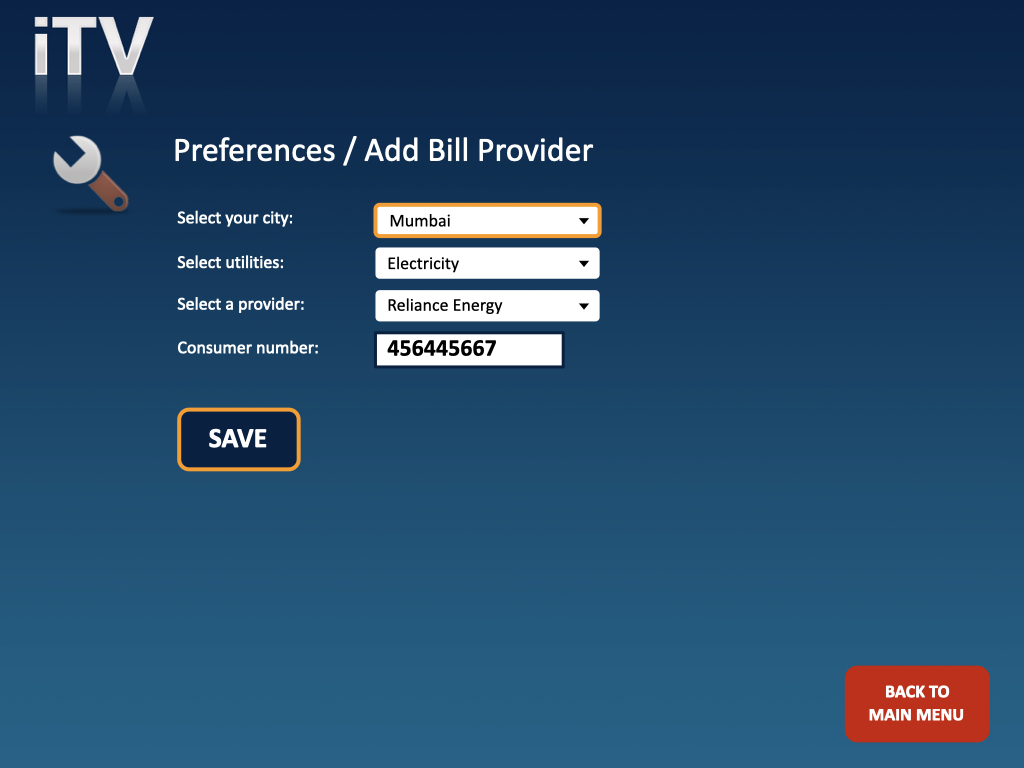

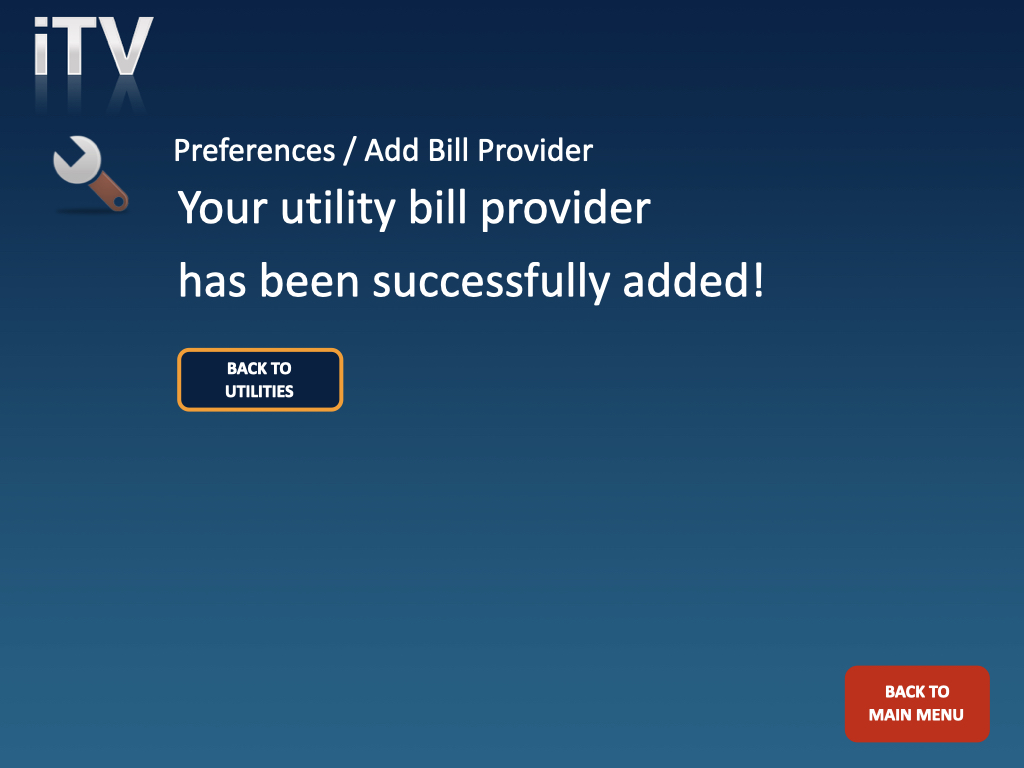

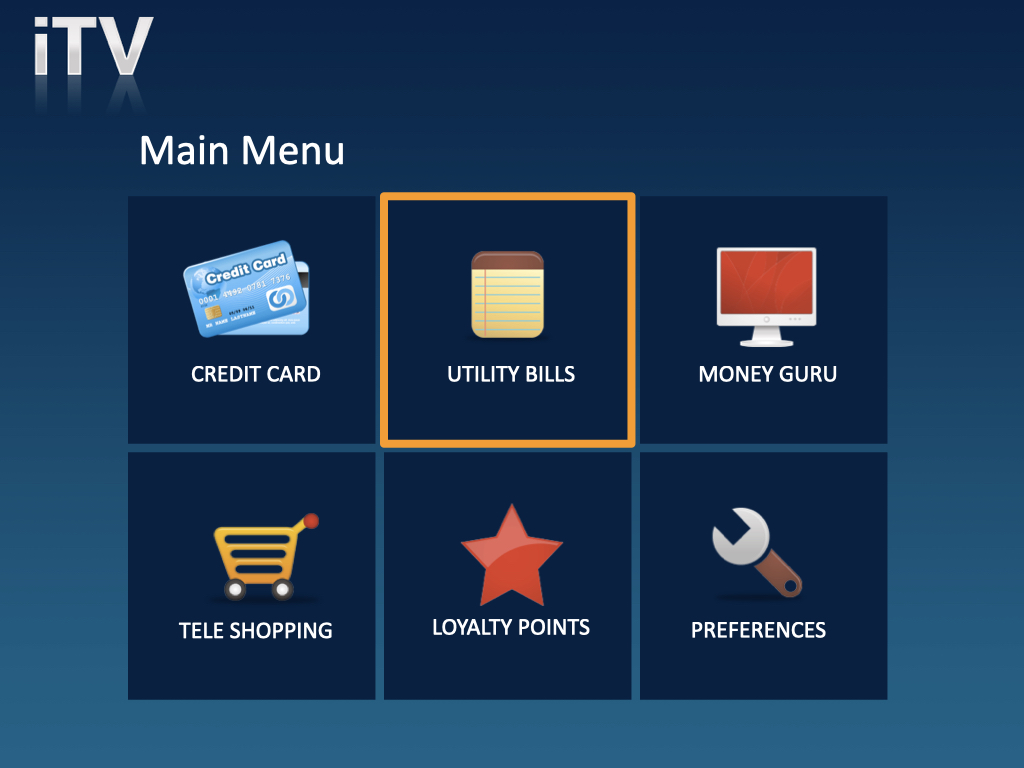

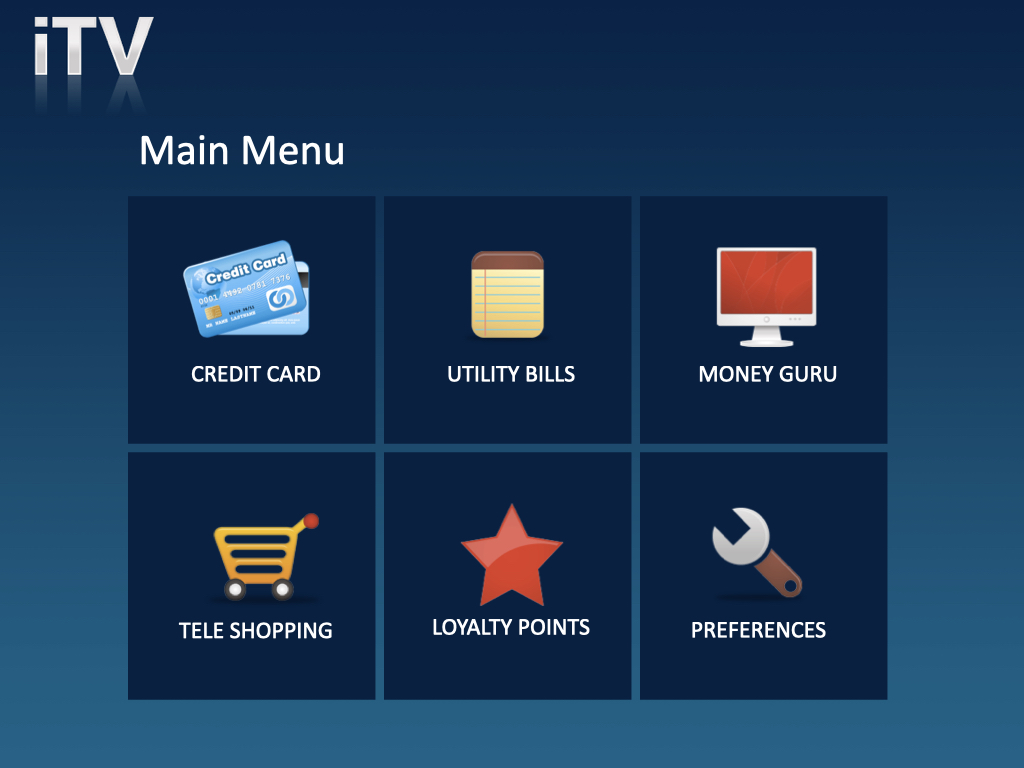

Interactive TV Banking: Main Menu

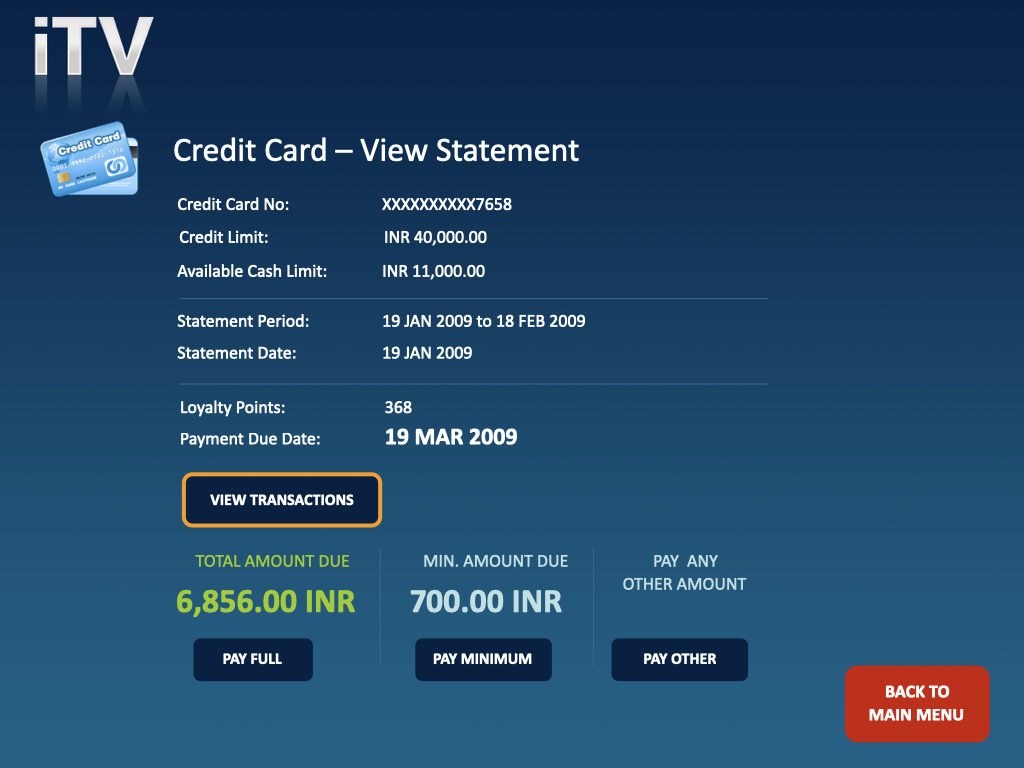

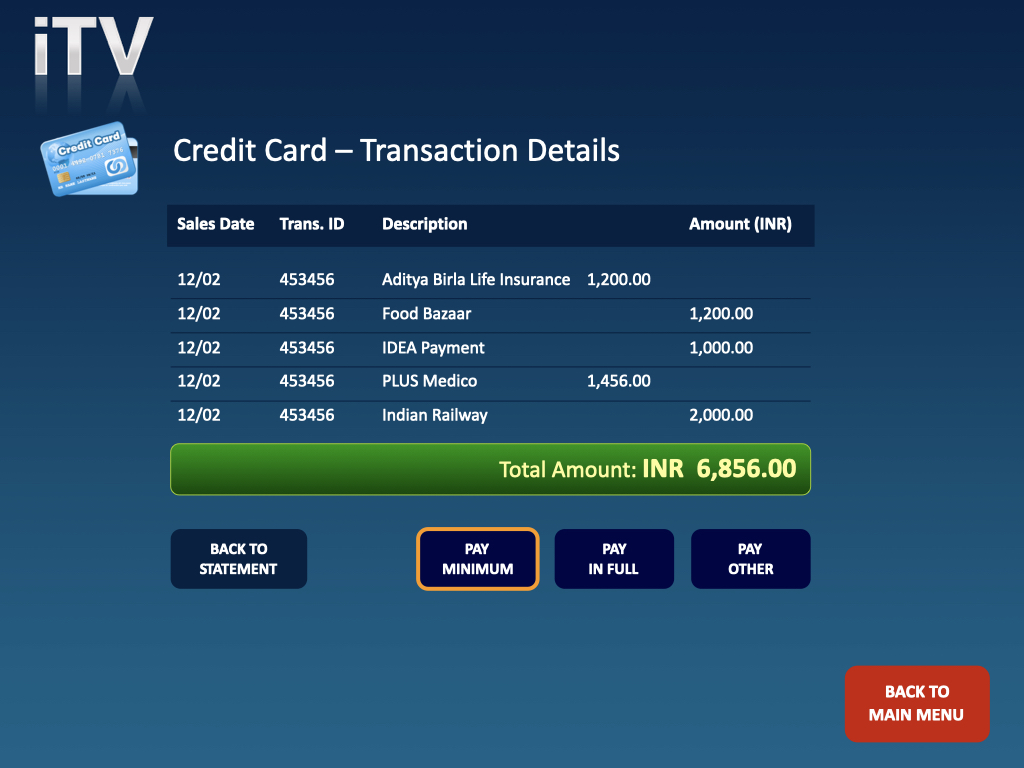

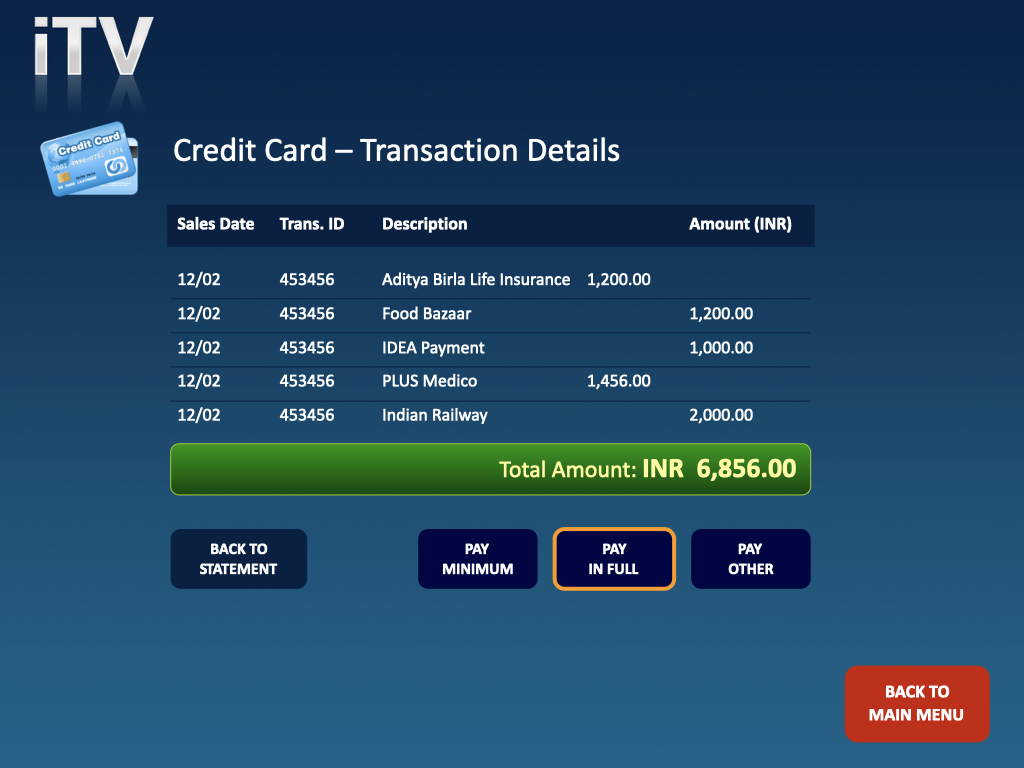

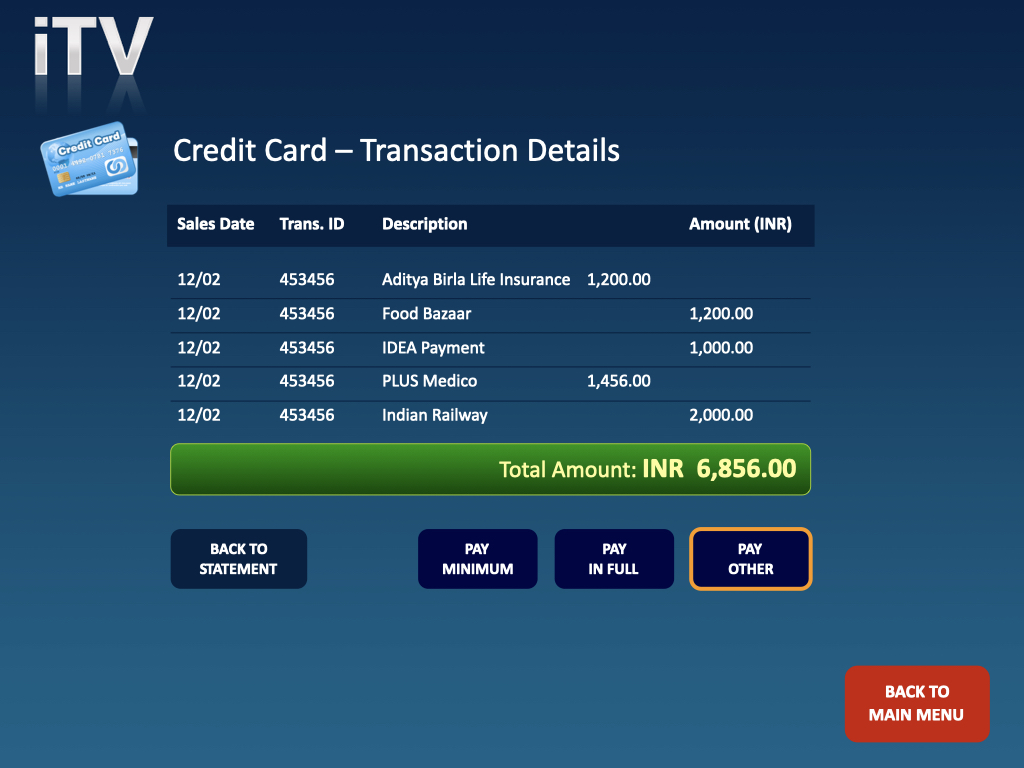

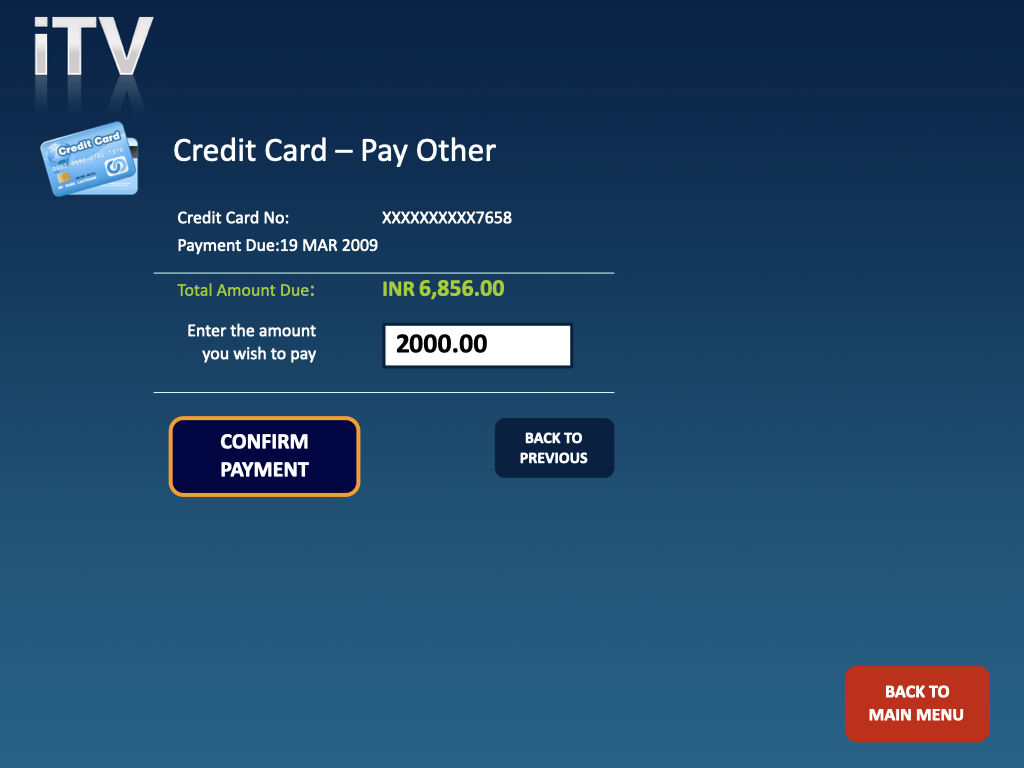

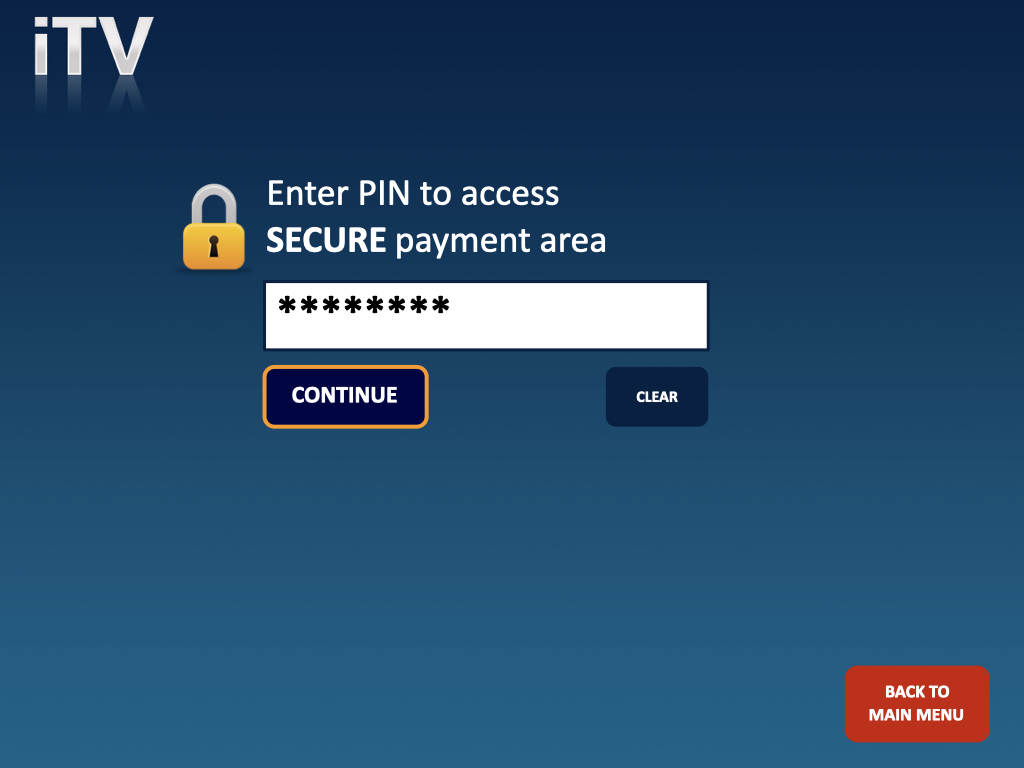

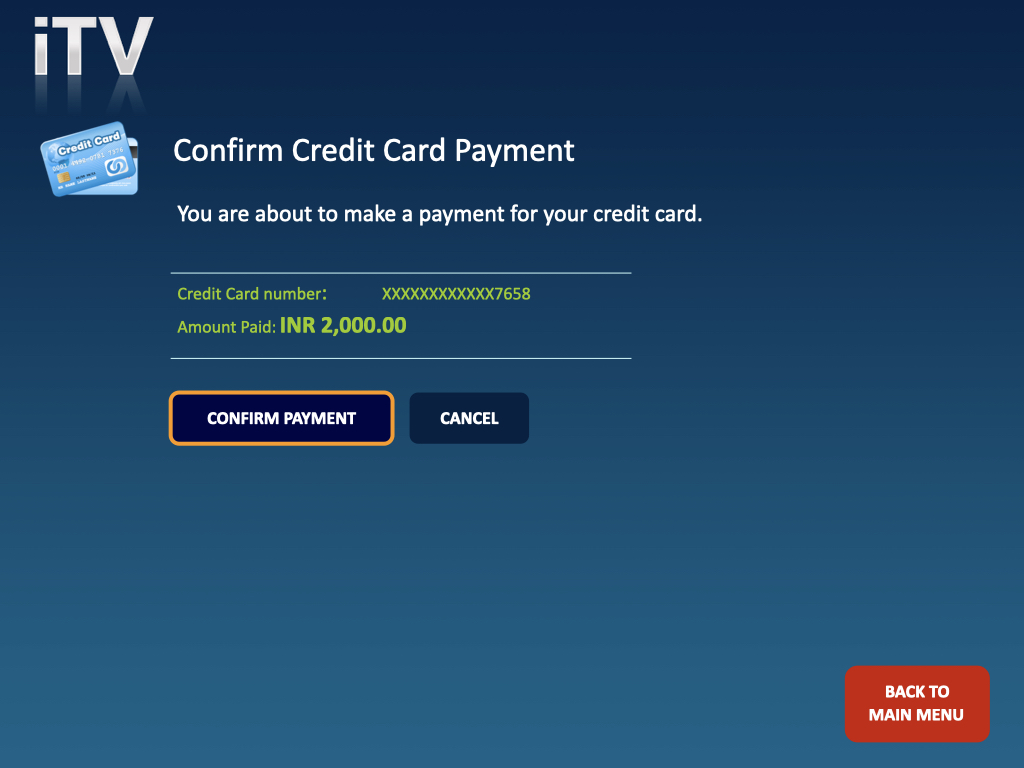

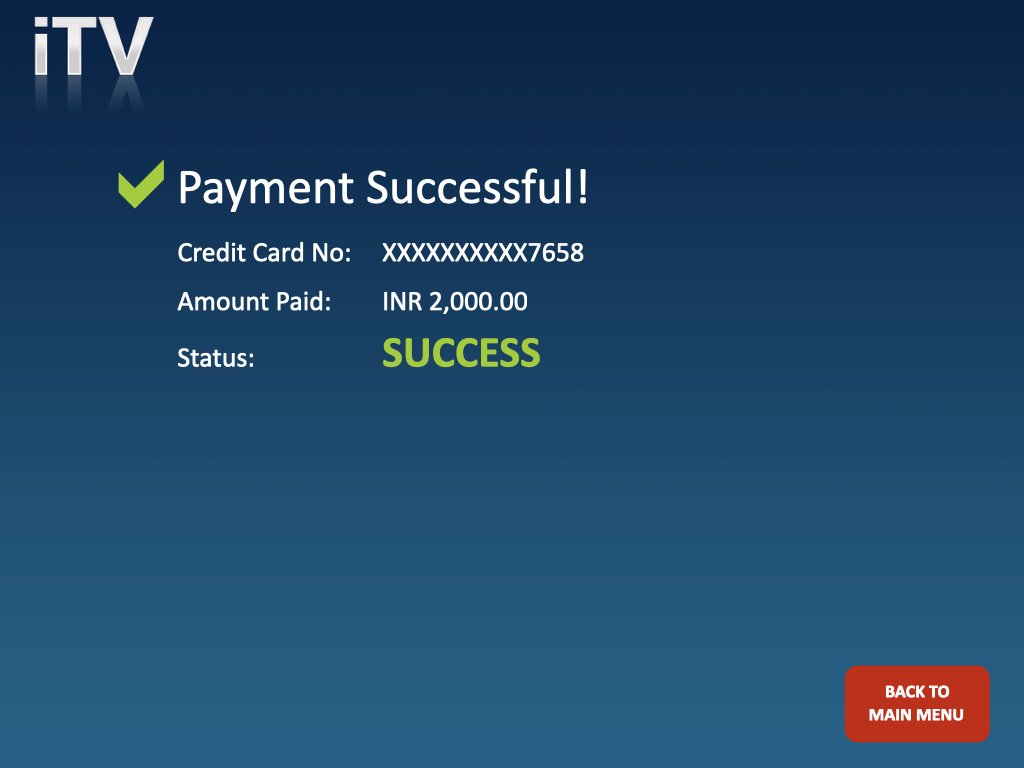

Scenario 1: View and Pay Credit Card Bill

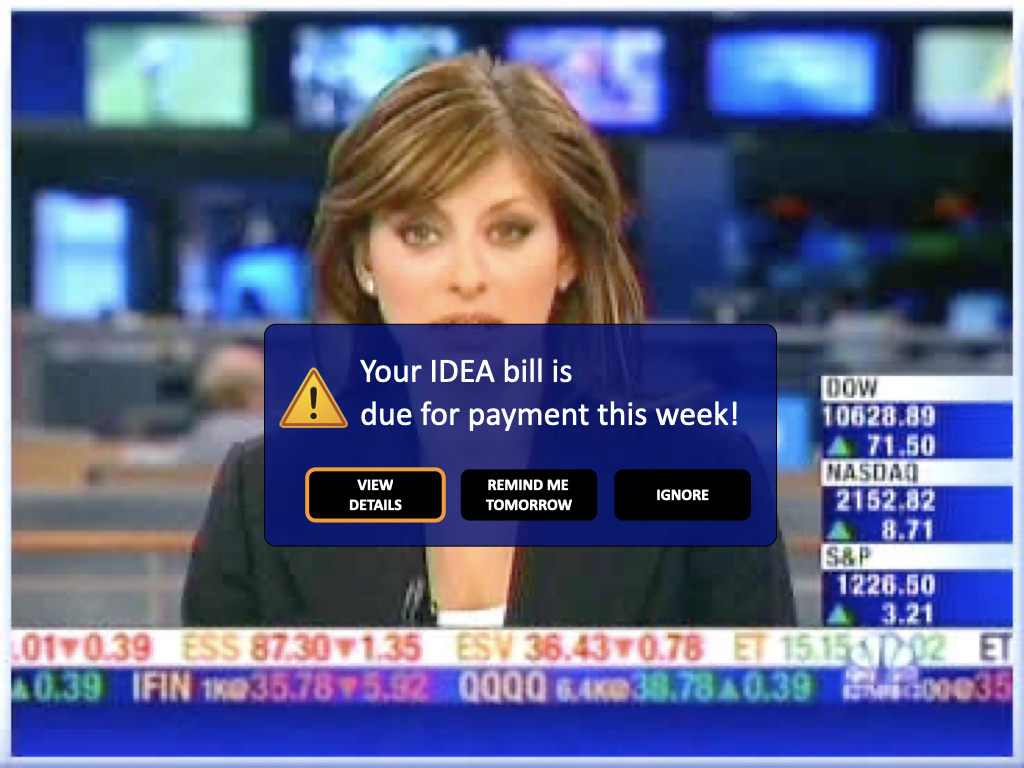

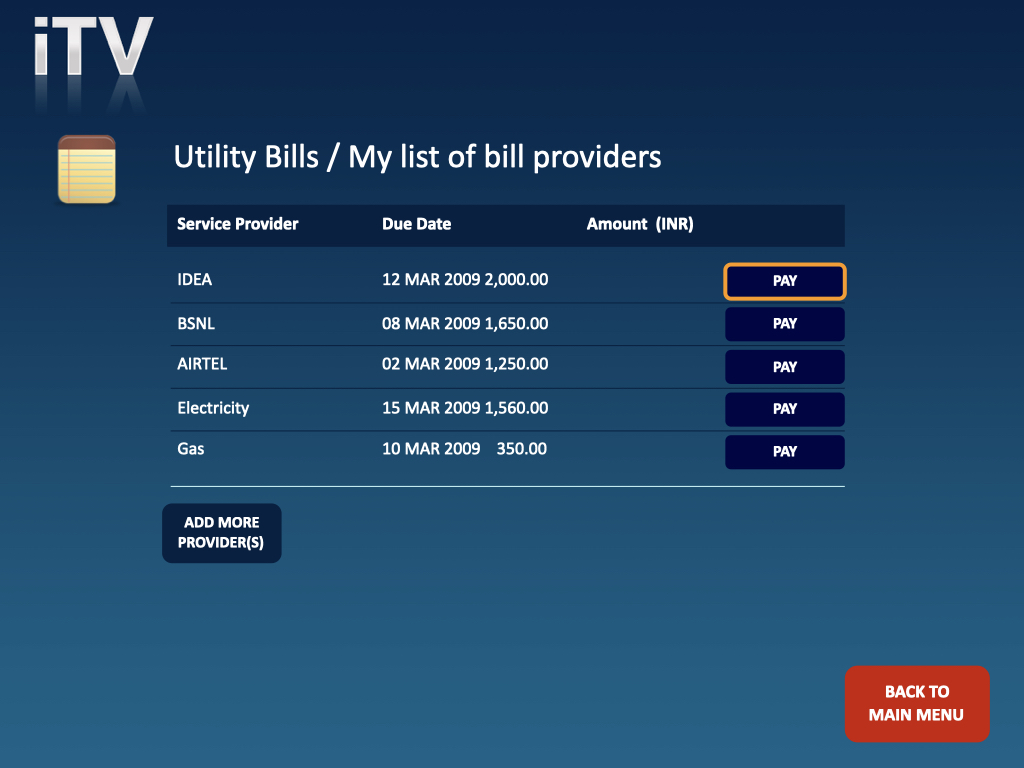

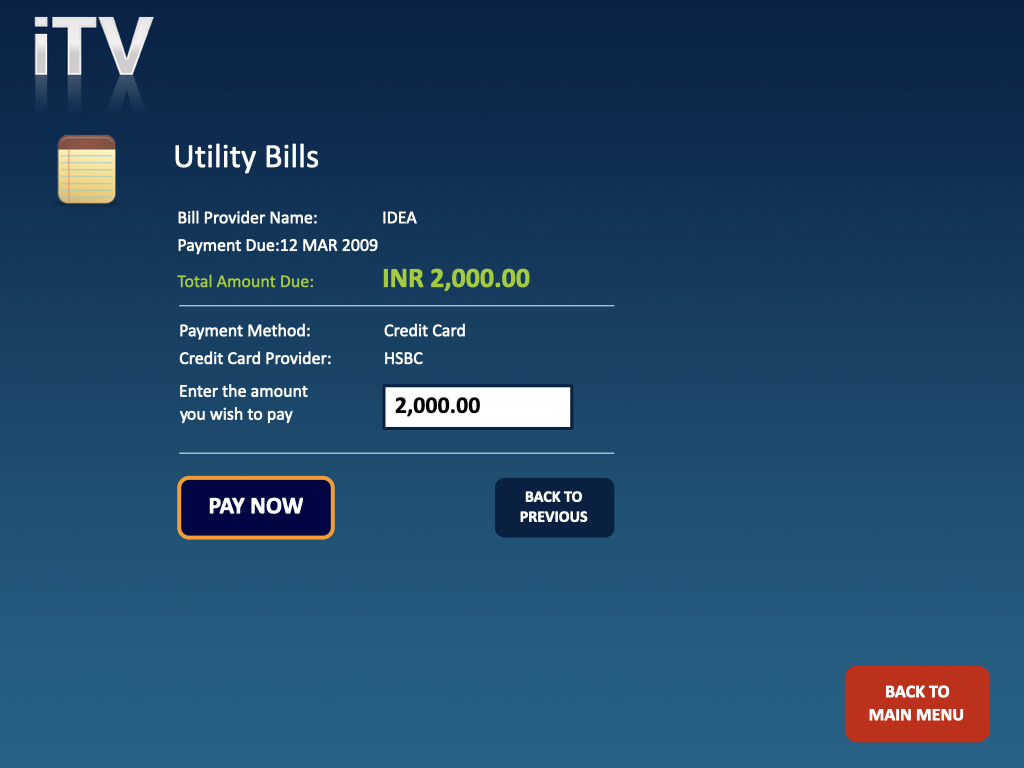

Scenarios 2: View and Pay Utility Bill

Summary of Key Findings

- 90% of consumers found the Interactive TV (iTV) concept useful and effective.

- While TV banking is a new concept in the Indian market, most consumers liked it for its security and convenience.

- The iTV credit card concept would likely succeed only if launched in conjunction with iTV banking services.

Recommendation on Marketing

- Leverage multi-channel promotions—launch the service with large-scale marketing campaigns spanning mobile, web, and TV, supported by the strong brand presence of DTH service providers, as people trust well-known brands.

- Emphasize security and convenience as the Unique Selling Proposition (USP) in marketing materials.

- Introduce the iTV credit card alongside the iTV banking service to reinforce adoption.

- Incorporate loyalty programs, particularly offering free video-on-demand or movie subscriptions, to drive engagement.

Recommendation on Functionality

- Improve confirmation mechanisms to ensure customers receive clear notifications for transactions, payments, and account updates.

- Integrate contextual help—offer dynamic help menus on a transparent overlay or voice-assisted guidance that users can toggle on or off.

- Enable multi-channel communication—send transaction confirmations, account changes, and other alerts via SMS and email for additional assurance.

- Adopt a multi-channel approach—provide a mobile and web-based iTV interface for users who may not always be in front of a TV.

- Enhance security measures—consider partnering with digital signature providers to strengthen trust in the service.

Consumer Perception

- Introduce a credit card with a lower limit to encourage adoption.

- Offer add-on cards for family members, including spouses and parents, as part of a family package, allowing shared access.

- Include premium pay channels (e.g., sports and movies) in the iTV credit card package, either free or at a discounted rate.

- Position the service as a “one-stop shop”, making it easy for consumers to compare with competitors and recognize its unique benefits.

- Focus on continuous innovation, as consumer expectations are high.

- Explore additional financial services, such as equity trading via iTV.

- Ensure the remote control remains the primary interaction tool, as users demonstrate a strong preference for TV-based navigation.

Challenges

- Consumers reacted negatively to using two different device interfaces for interaction.

- RBS should only launch the service with providers capable of two-way communication between the set-top box (STB) and the backend system.

- Consider mobile devices as a tool for push notifications, helping deliver updates to STBs without two-way communication, but avoid using mobile as a substitute for full interaction.

This research provided critical insights into consumer behavior, usability challenges, and market opportunities, helping shape a strategic roadmap for RBS’s Interactive TV banking initiative.

See other Case Studies.