Context

Women-owned businesses have experienced significant growth over the past decade. As of January 2017, there were an estimated 11.6 million women-owned businesses in the U.S., employing nearly 9 million people and generating over $1.7 trillion in revenue. Between 1997 and 2017, the number of women-owned businesses increased by 114%, compared to a 44% increase for all businesses.

- Over 37% of small and growing businesses are owned by women.

- Advancing women’s economic equality could contribute an additional $12 trillion to global growth by 2025.

Opportunity

Despite this tremendous growth, women entrepreneurs continue to face challenges:

- In 2016, only 16% of small business loans in the U.S. were granted to women-owned businesses.

- Only 2% of venture capital funding goes to women.

- Just 2% of women-owned businesses reach the $1 million revenue mark.

This presented a major opportunity for BNP Paribas to act as a responsible corporate citizen, leveraging its resources to support women entrepreneurs while accelerating growth in this key segment.

Innovation Idea

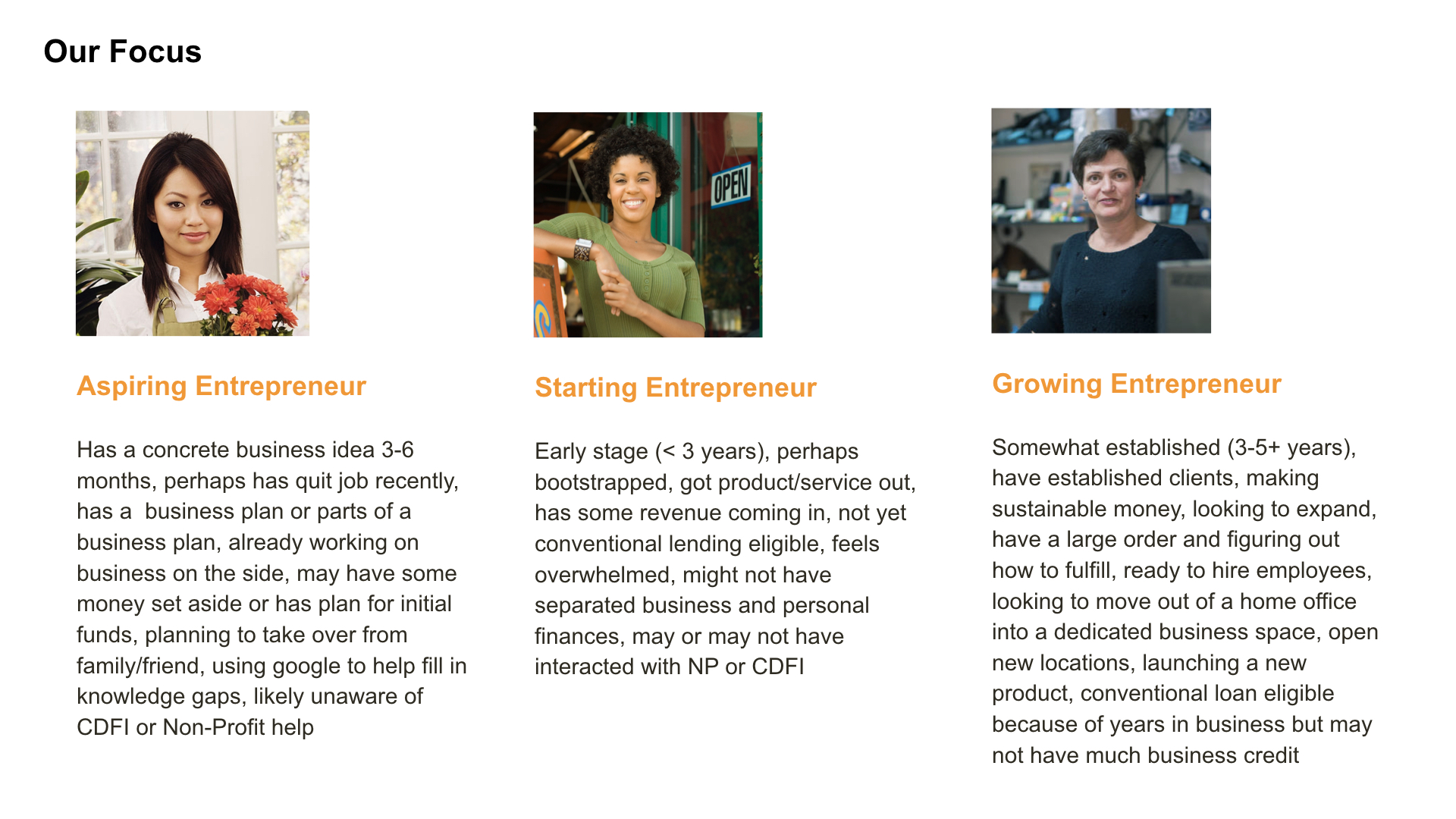

Recognizing these challenges, BNP Paribas explored an innovative solution to empower women entrepreneurs by leveraging a broad ecosystem of banks, non-profits, government agencies, and corporate partners.

The result was Pathways – a digital platform designed to support and engage women entrepreneurs throughout their entrepreneurial journey. The platform’s goal was to provide women with the tools, resources, and mentorship necessary to build successful businesses and enhance their economic well-being – both individually and within their communities.

My Role

As Product Owner, I led the innovation effort from inception to execution, overseeing all aspects of the product development process, including:

- Conducting user and market research to identify opportunities

- Facilitating Design Thinking workshops to synthesize key insights

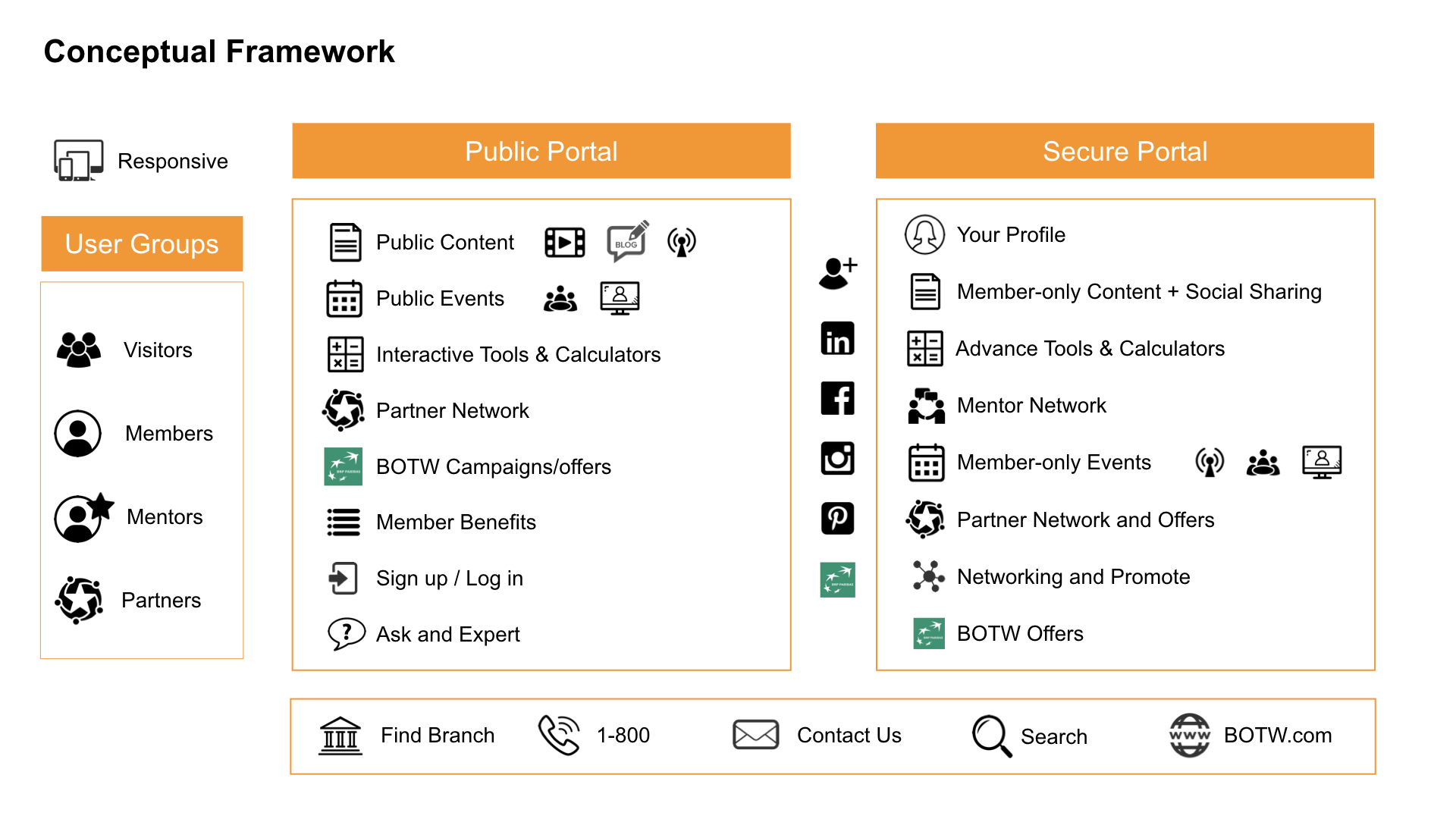

- Building the conceptual framework and outlining the product roadmap

- Developing the business model canvas and securing funding

- Creating the product backlog and defining the Minimum Viable Product (MVP)

- Establishing Agile teams and directing design and engineering efforts

- Supporting product marketing and establishing an analytics framework

- Overseeing product testing and MVP rollout

I led a 25-member cross-functional product team, delivering the project in a record timeline of under 12 months – from an idea to the initial roll-out in Northern California.

Product Concept

Here is a concept video that illustrates the product idea based on insights on the user needs and opportunity for the bank to innovate.

Research and Design

Web Portal for Women Entrepreneurs

Bank launched a web portal (as MVP) to promote the program and reach out to women in the communities across target markets such as SF Bay Area, Sacramento, LA, Denver and Phoenix.

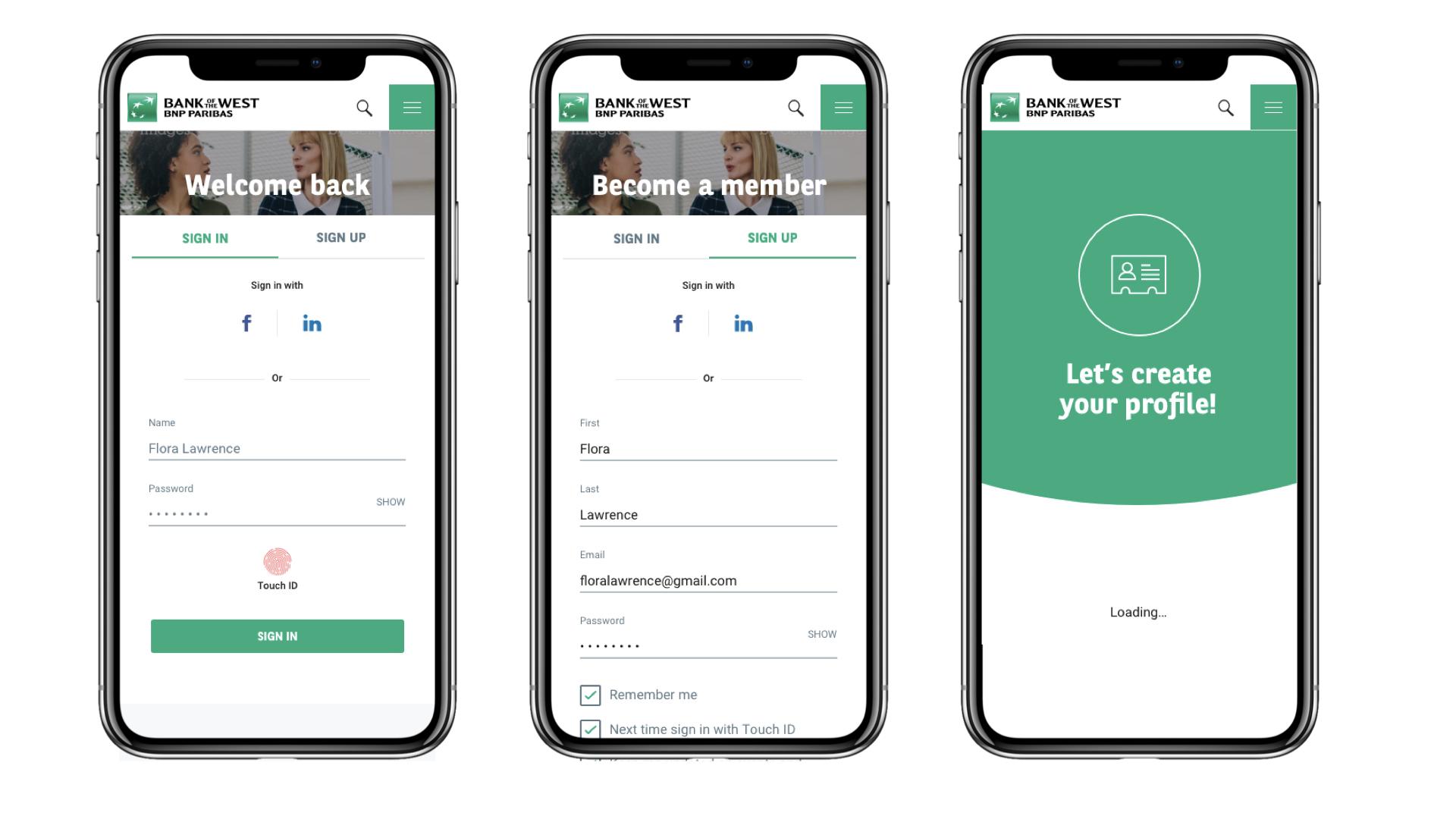

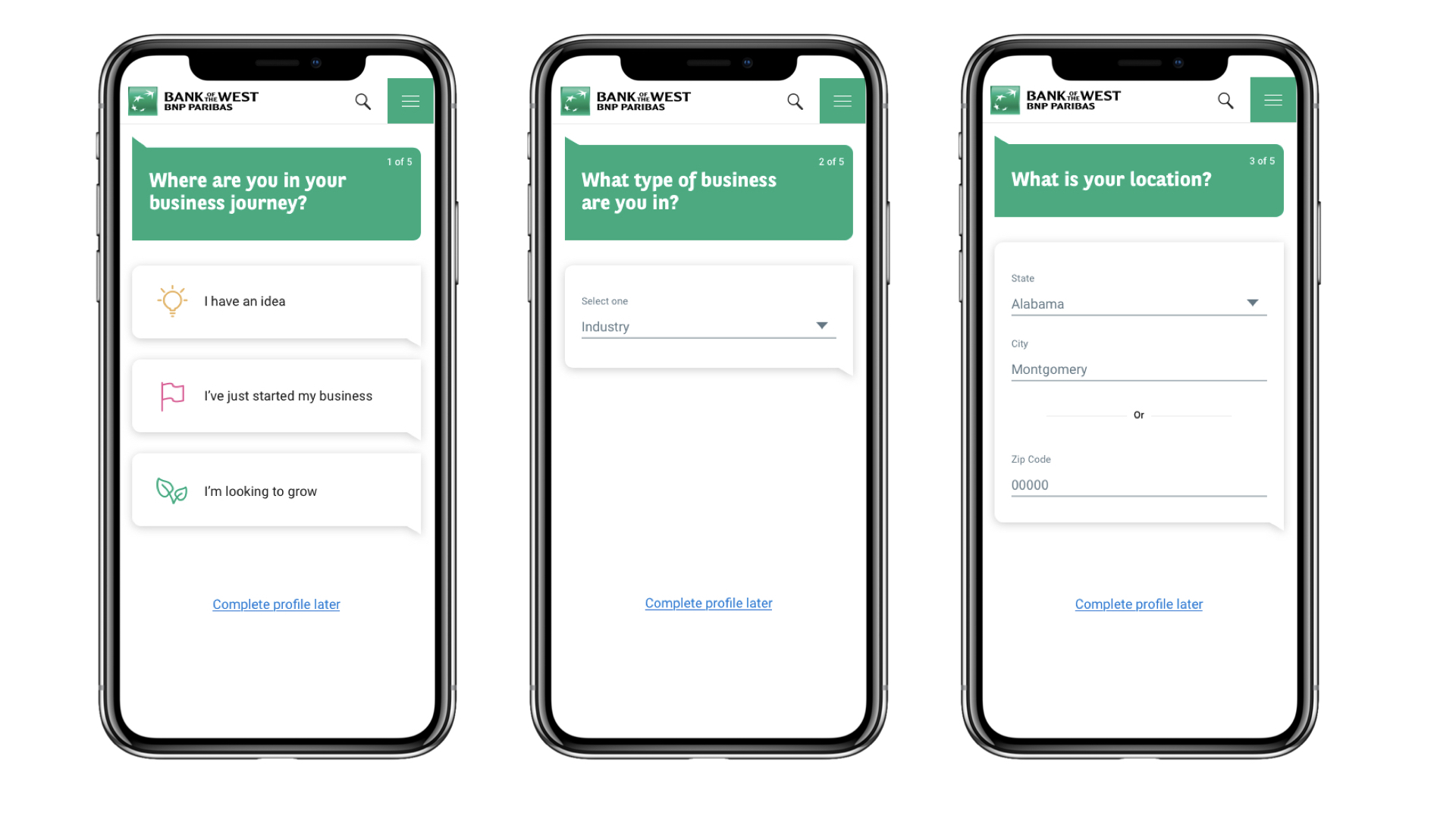

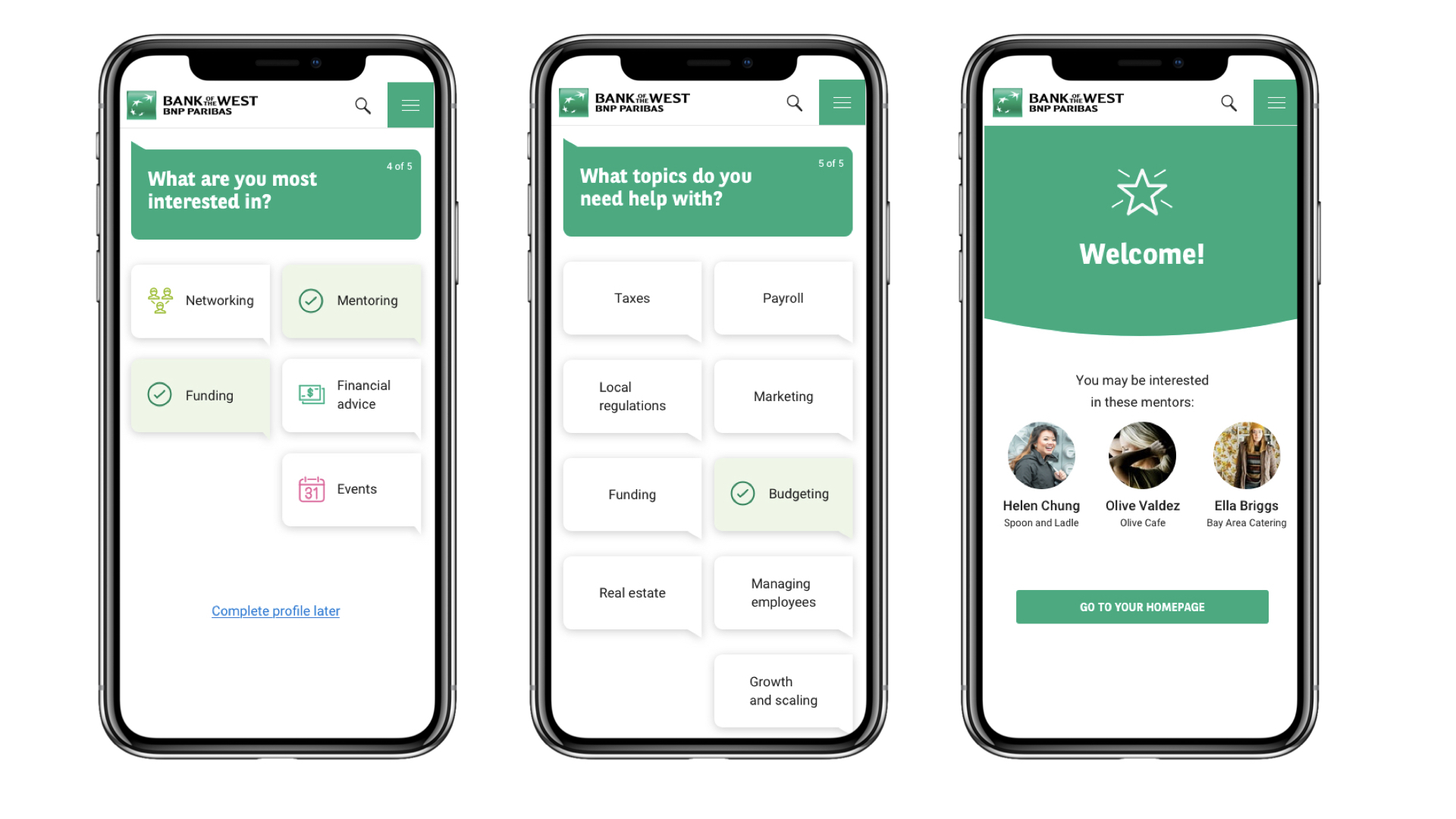

Member On-boarding Experience

Following illustrates mobile experience when the members initially sign up on the platform (this is work in progress).

Customer Journey

Following video illustrates how Pathways enables women to start, build, and grow their business with help of the bank.

Business Impact

Engaging with entrepreneurs early in their journey allows the bank to support their growth while positioning itself as a trusted financial partner. By providing education, advice, and engagement, the bank enhances brand awareness and ensures it remains in the consideration set when entrepreneurs choose banking products and services.

This initiative has created a halo effect, driving:

- New customer acquisition

- Retention and loyalty among existing customers

- Cross-sell and up-sell opportunities through personalized financial solutions

The integration of digital platforms for onboarding, account opening, and lending has significantly reduced friction, making it easier for platform members to seamlessly convert into Bank of the West customers.

Since its launch in December 2018, the platform has gained significant market traction, successfully connecting thousands of women entrepreneurs with valuable content, expert consultants, and access to capital to launch and grow their businesses.

The next phase of the platform will introduce:

- Peer-to-peer networking and mentoring to foster collaboration

- Exclusive events and workshops for entrepreneurial growth

- Expanded access to capital through partnerships with FinTech lenders

This continued evolution will further strengthen the platform’s impact, ensuring long-term engagement and success for women entrepreneurs.

See other Case Studies.