Context

Small and Medium Enterprise (SME) banking accounted for nearly 40% of the bank’s revenue and was among its fastest-growing business segments. However, rising costs of customer acquisition, service, and retention – driven by outdated products, processes, and platforms – posed significant challenges.

Additionally, changing customer expectations and the rise of FinTech competitors intensified the competition, particularly in key markets like California, where attracting new customers became increasingly difficult.

- Entrepreneurs prefer to focus on growing their business, not managing banking complexities.

- The bank’s onboarding processes and platforms were outdated and inefficient.

- Customer onboarding could take up to three months due to extensive documentation, manual Know Your Customer (KYC) processes, and the lack of digital tools.

- Small business customers expect a frictionless, intuitive, and self-guided banking experience.

- FinTech disruptors were providing modern, app-based point solutions with best-in-class customer experiences, intensifying competitive pressure.

- Small business owners now expect banking services to match—or exceed—the seamless experiences offered by FinTechs.

- While customers value the personalized service and human touch provided by the bank, they also expect it to modernize its processes, tools, and products to stay relevant.

My Role and Approach

As the Customer Journey Lead, I played a key role in launching this multi-year transformation initiative. Partnering with the Chief Product Owner and the EVP of Small and Medium Enterprise (SME) Banking, I led a cross-functional team of 15 experts to map the customer journey, identify pain points, and define strategic solutions.

Over the course of eight months, I led and coordinated efforts across the following phases:

- Defining Vision & Success Metrics

- Articulated the purpose, vision, and success criteria in collaboration with key stakeholders.

- Conducting Extensive Field Research

- Interviewed ~30 SME customers and ~50 internal users across key segments:

- Small businesses (<$25M annual revenue)

- Mid-market businesses ($1M-$5M annual revenue)

- Micro businesses/startups (<$1M annual revenue)

- Engaged with key internal stakeholders:

- Relationship Managers, Sales Support, Marketing, Risk, Legal & Compliance, Customer Support, Operations, Branch Staff, and IT.

- Interviewed ~30 SME customers and ~50 internal users across key segments:

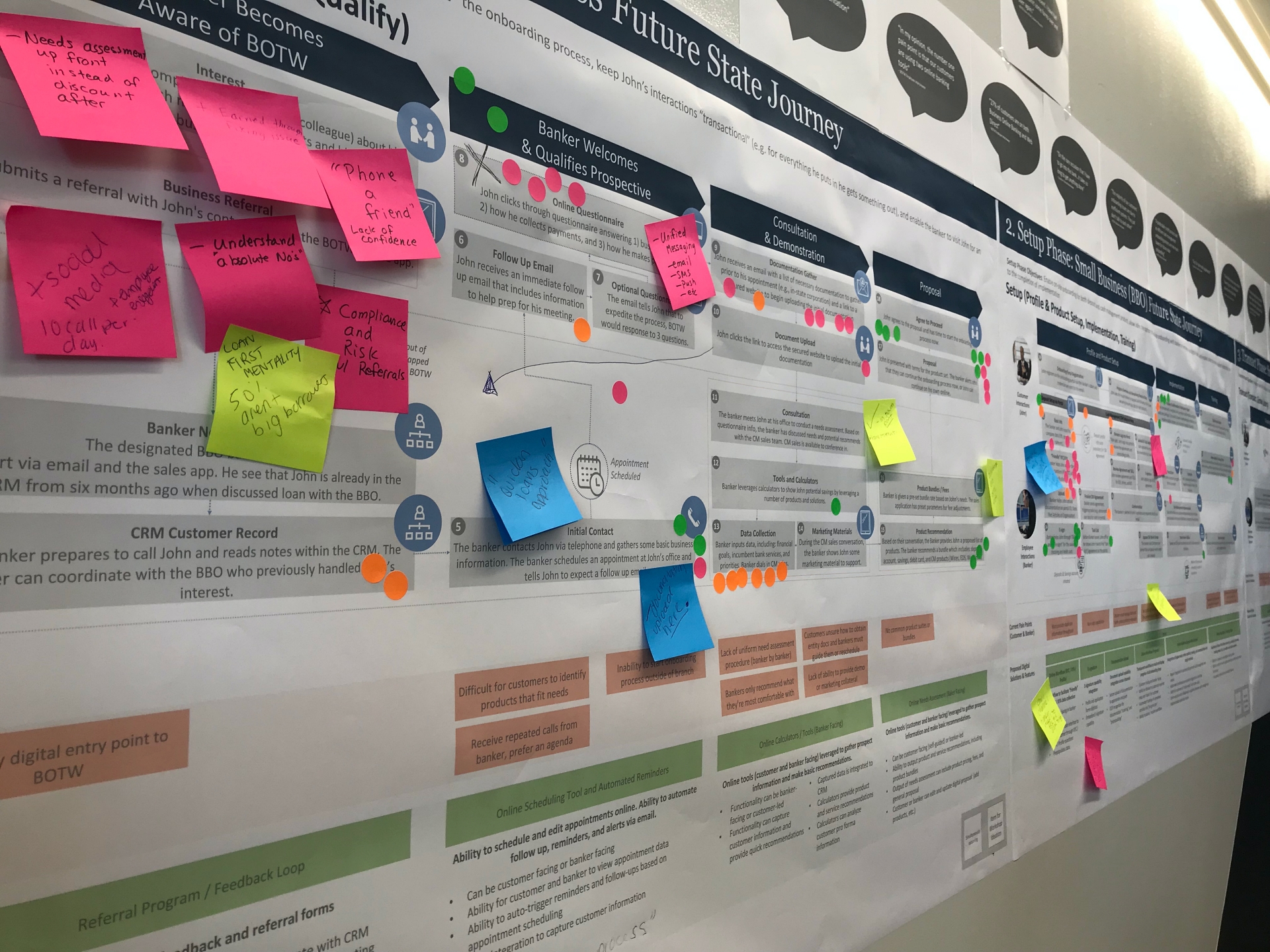

- Mapping the Current-State Customer Journey

- Captured customer interactions across all channels (digital, physical, and human touch points).

- Identified friction points across people, processes, platforms, and customer-facing channels.

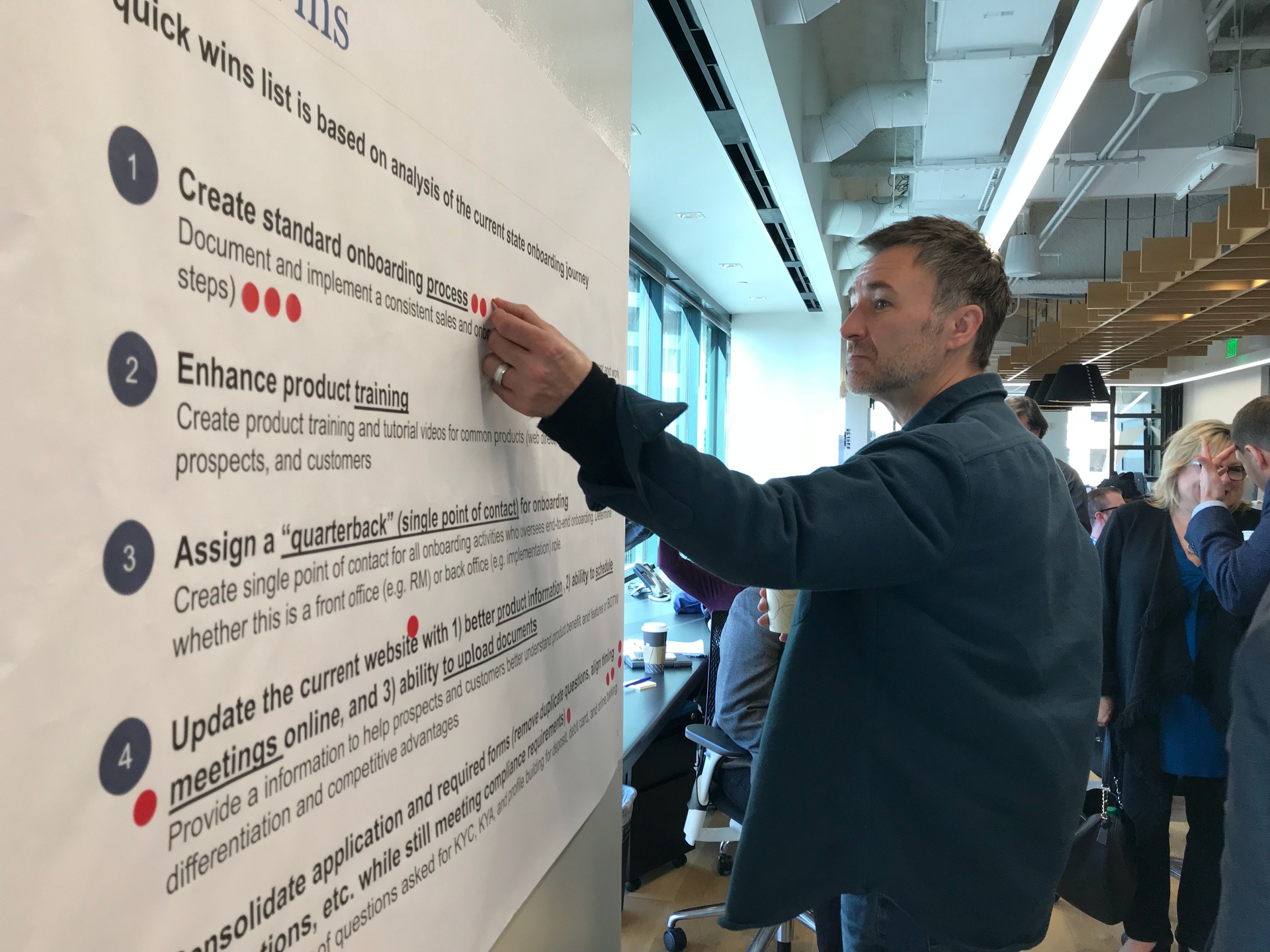

- Ideating & Prioritizing Solutions

- Brainstormed potential solutions, including short-term quick wins and long-term strategic initiatives.

- Prioritized solutions based on customer value and investment readiness.

- Defined a target-state customer journey, outlining key areas for improvement and innovation.

- Defining Architecture & Digital Investments

- Developed a high-level architecture for digital investments and IT infrastructure.

- Used rapid prototyping to test concepts with customers and internal stakeholders.

- Building the Product Roadmap

- MVP definition

- Prioritized product backlog

- Key initiatives for phased execution

- Securing Funding & Agile Program Setup

- Created a Business Model Canvas and drafted the initial funding request (OpEx & CapEx).

- Led sprint planning and team setup for the multi-year Agile development program.

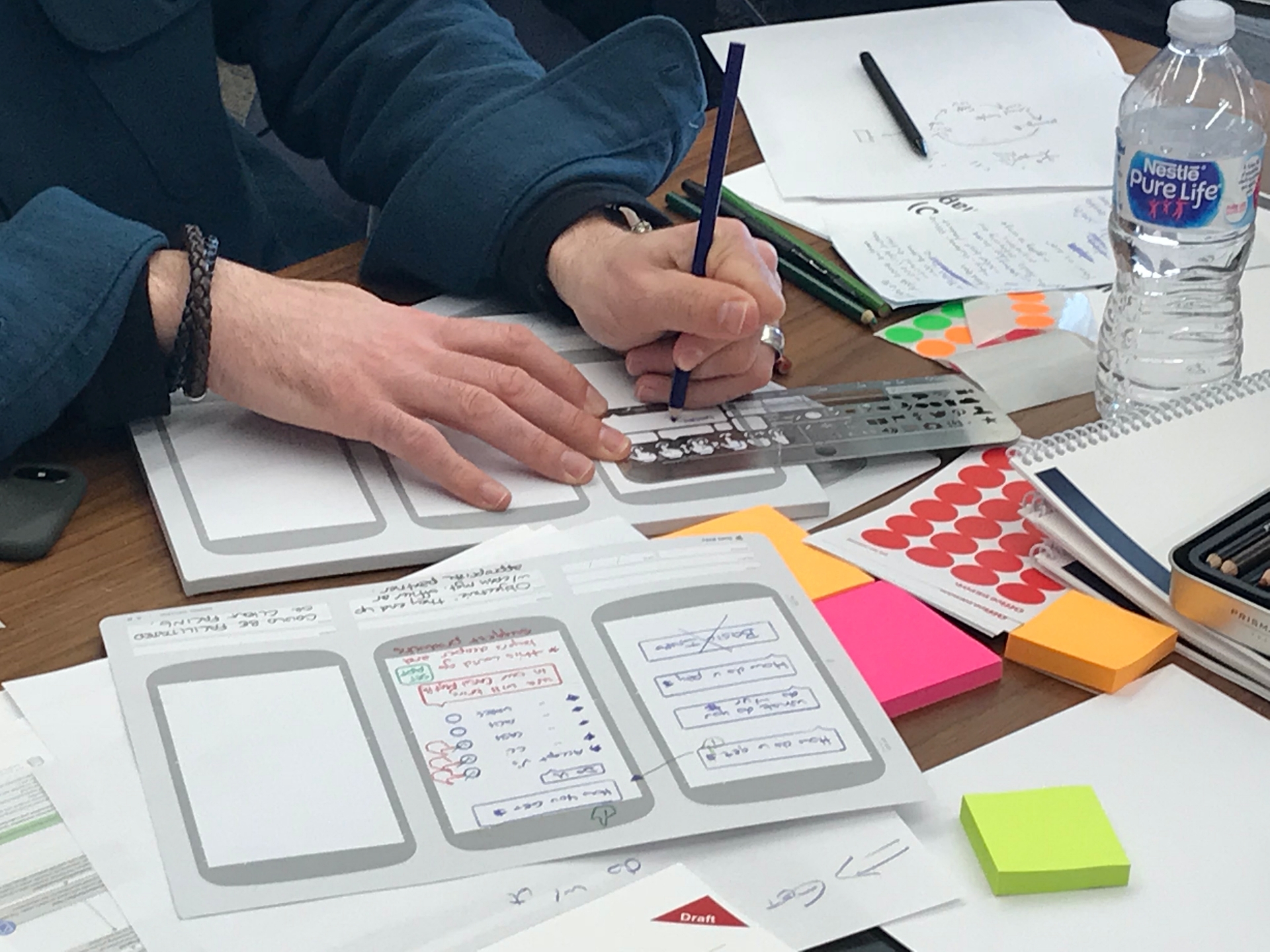

Design Thinking Workshops

I planned and conducted a series of Design Thinking workshops and workstreams, engaging a dedicated cross-functional team within the bank. These multi-day sessions were designed to align stakeholders, generate ideas, gather feedback, and prioritize initiatives.

The focus of each workshop varied, covering key phases of the product development and innovation process. Examples include:

- Vision & Alignment – Establishing a shared vision, purpose, and success criteria with stakeholders.

- Customer Understanding – Defining customer segments and personas using empathy maps.

- Field Research Readout – Presenting insights from customer research and mapping the current-state journey.

- Ideation & Concept Development – Generating ideas for process improvements, product enhancements, and platform innovations.

- Target-State Journey & Prototyping – Defining the future-state customer journey and creating interactive prototypes.

- High-Level Architecture & Product Roadmap – Outlining the technical architecture and prioritizing key product initiatives.

- Business Model Development – Structuring the business model canvas to align strategy with execution.

These workshops played a critical role in driving collaboration, fostering innovation, and accelerating decision-making, ensuring that solutions were customer-centric, scalable, and strategically aligned.

Storyboard and Concept Video

Here is a concept video illustrating the proposed onboarding journey of a small business customer.

Business Impact

This program was the first of its kind at the bank, marking a significant step in its digital transformation journey. It introduced a customer-journey-based approach and adopted Agile methodologies to organize teams and develop products more efficiently.

Customer Impact

- Deeper Customer Understanding – Gained clear insights into customer needs, behaviors, and expectations from the bank.

- Enhanced Relationship Management – Reconfigured relationship teams to provide a single point of contact throughout the onboarding process, improving customer experience.

- New Digital Platform – Launched a customer-facing digital platform to streamline communication and documentation, significantly reducing processing costs.

- Reduced Onboarding Time – Achieved over 40% reduction in onboarding time for micro-businesses (<$1M revenue).

- Lower Drop-Off Rates – Reduced onboarding drop-offs by 22% for mid-market businesses ($1M-$5M revenue).

- Increased Product Adoption – Improved product-per-customer ratio by ~18%, leveraging better customer insights to enable targeted cross-selling during onboarding.

People Impact

Beyond customer benefits, the program drove organizational change, accelerating the bank’s Agile transformation within SME Banking:

- Embedded Human-Centered Design – Fostered a deeper understanding and appreciation of customer journey mapping and design thinking.

- Adopted Agile & Cross-Functional Collaboration – Encouraged teams to work iteratively, collaboratively, and efficiently.

- Attracted & Retained Talent – Helped the bank attract, develop, and retain top talent in product, design, and technology.

- Showcased a New Way of Working – Established a model for future innovation initiatives, reinforcing customer-centricity and agility within the organization.

See other Case Studies.